Post covid challenges in Construction Equipment industry

This article discusses a macro perspective, focusing on the industry as a whole (and not on OEMs as individual entities). There is a separate article for that which discusses possible solutions as well.

Gita Gopinath, chief economist of International Monetary fund mentions the current economic downturn as worse than the great depression1. Assuming positive scenario, she estimates 3% reduction in global output. Almost all sectors of business have taken hit. Construction equipment industry is no exception. Like other manufacturing segments it faces challenges in demand, supply and perhaps resources.

Demand

Construction equipment sales in India seems to be influenced by political scenario, Govt. expenditure in infrastructure and amount of new projects allotted.

Political Scenario

Political scenario in India does not look volatile under current circumstances. There is still time for next Loksabha election. Political unrest or uncertainty is not foreseen yet. Hence, it can be concluded that political scenario should not throw any challenges or obstacles. Rather, the scenario is positive for the industry.

New projects

India already has a huge plan of investment in infrastructure. Last December, the plan of investment of $1.5 trillion in infrastructure over next 5 years was mentioned by the finance minister.2 Hence, projects are in pipeline. Additional investments to combat slowdown may also be planned. The challenge however is whether or not and when these projects will be awarded. This is because the government may have to give priority to relief measures, as it did recently3. This expenditure may delay the planned projects for short time. Hence the scenario is doubtful.

Expenditure

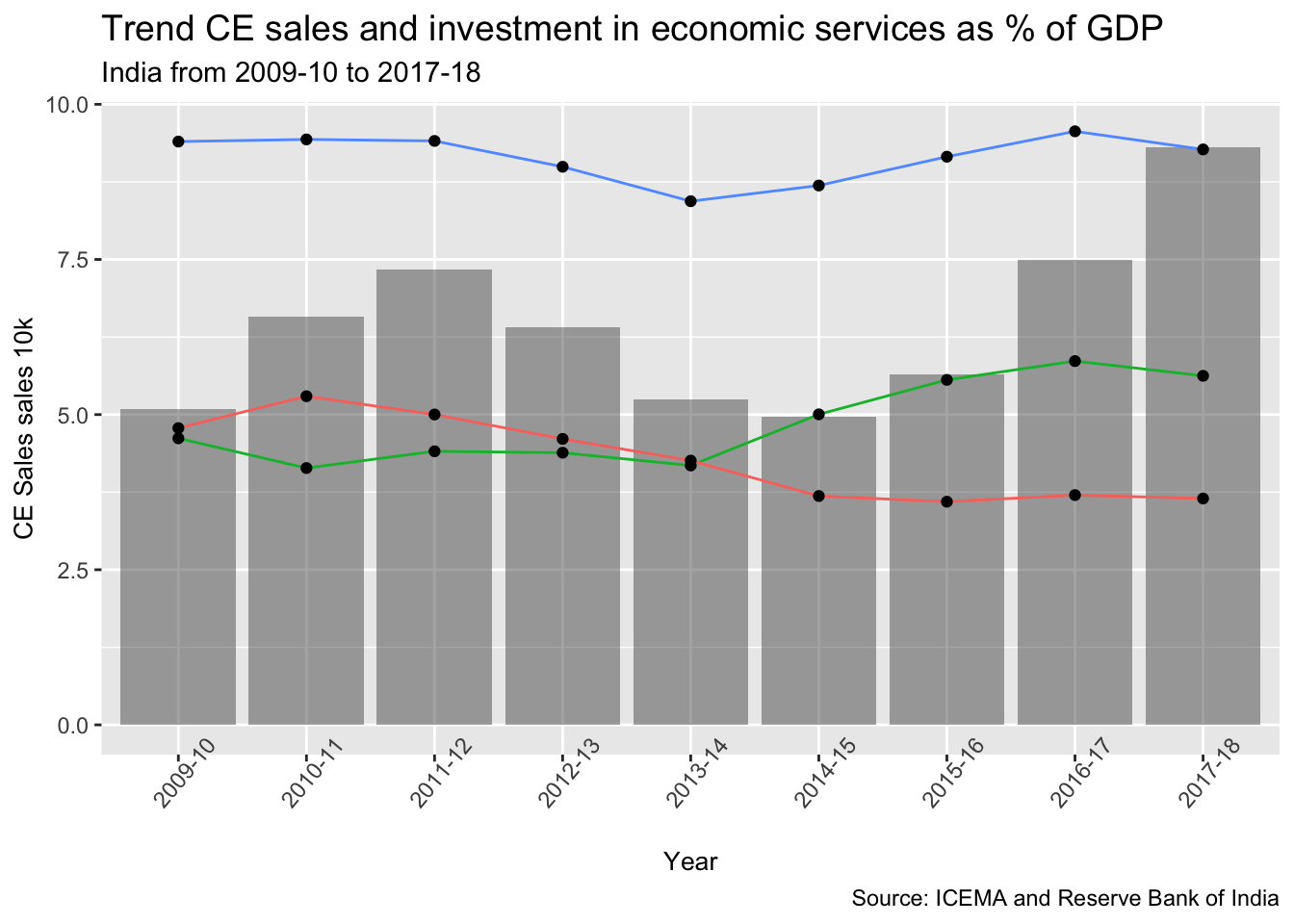

The momentum of expenditure in service of economy (hereafter mentioned as expenditure) may not sustain in current situation. This is because the slowdown demands relief measures, which necessarily is priority. Moreover, since 2014-15, there has been increasing dependency on state governments (shown in figure below). This has already been mentioned as a cause of concern by CRISIL4. The current slowdown certainly makes it worse.

Supply

Manufacturing industry across the globe is worried about the threat to its global supply chain network. The vulnerability is higher in small suppliers who may struggle with interest burden and falling revenues (resulting in negative cash flow). OEMs of construction equipments have halted production at many places across the globe, but not all. For e.g. Hitachi plant is operational in Japan, China and Indonesia.5 Komatsu has also resumed production in China6. These show that supply constrains are temporary and geography dependent. Nonetheless, ongoing Chinese and Japanese operations are relief for Indian OEMs who depend on import from these countries. On the other hand, companies dependent on Korea, US and Europe may have to wait for a while.

Several Indian models are indigenous and do not depend on imported parts. The suppliers are currently not operational due to lockdown. However, restrictions are being lifted on industrial activities in several places in India7. As pandemic situation improves, the lockdown will be further relaxed and supply should smoothen up.

Finally, in case of some OEMs, a buffer of stock at dealer end is expected. This buffer can help mitigate the possible delay in supply chain becoming fully functional. In fact, clearing up this stock could be an issue because of possible challenges in demand.

Hence, overall, supply should not be a major risk for Indian OEMS. Albeit, it may take some time to smoothen up.

Resources

With consumptions down to zero, just like in case of the suppliers, OEMs are also pressed for revenue. With increasing interest burden and fixed expenditures, sustaining business may be difficult for companies with weak finances. The seemingly growing investor confidence (since the share prices of construction equipment manufacturers are recovering as of now) looks like a silver lining.

Even in case of some shortage of money, business in India should remain a priority for all the OEMS in CE industry. Firstly, several of the OEMs (MNCs) have invested or are investing in new plants in India. This include giants like JCB8 and Doosan9.

Secondly, despite the situation, economic forecast of India is still better than most of the major economies10.

Summary

| RISK HEAD | REASON | RISK |

|---|---|---|

| Overall in Demand | *** | |

| Political | Political Scenario is Stable | * |

| Projects | $1.5 trillion investment declared for next 5 years, but delay is possible | *** |

| Expenditure in infrastructure | May have to wait or money needs to be arranged | **** |

| Supply | ** | |

| Imported Parts | Production on in China and Japan but off in Korea, Europe and US | ** |

| Indigenous Parts | Lockdown duration not clear | ** |

| Resources/Money | Investor confidence is growing | ** |

To summarise, at this point, demand looks like the biggest challenge for construction equipment industry in coming days in India. This is despite new infrastructure projects in pipeline. The reason is deficit and debt. Once Govt. comes up with a favourable fiscal policy (and money), this challenge may become opportunity. However, that is remains a question till now.

Another risk factor is the financial condition of companies who may struggle to sustain this period of zero to low revenue, till the demand picks up.

Update

According to sources, new information has come to light. Dependency on credit availability exists in the industry. Most of the customers buy using credit from NBFCs. Since sometime now, NBFCs in India are having a tough time because of increasing NPAs11. One of the reason of course in lack and delay of payments which has been discussed in the demand section. Under these circumstances, the risk becomes higher because the NBFCs may decide to restrict funding. Hence, demand may struggle to convert to actual sales because of (lack of)availability of money. Hence, dependency on expenditure is high, as concluded earlier.

https://blogs.imf.org/2020/04/14/the-great-lockdown-worst-economic-downturn-since-the-great-depression/↩︎

https://www.bloomberg.com/news/articles/2019-12-31/india-plans-1-5-trillion-infrastructure-spending-to-spur-growth↩︎

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49659↩︎

https://www.crisil.com/content/dam/crisil/our-analysis/reports/Infratstructure-Advisory/documents/2019/november/infrastructure-conclave-summary-presentation.pdf↩︎

https://www.hitachicm.com/global/news/important-notice-en/important20-04-06e/↩︎

https://home.komatsu/en/press/2020/others/1205557_1845.html↩︎

https://www.livemint.com/news/india/full-list-of-services-and-activities-which-will-begin-from-tomorrow-during-coronavirus-lockdown-11587277052339.html↩︎

https://economictimes.indiatimes.com/industry/indl-goods/svs/engineering/jcb-to-invest-rs-650-crore-in-india-makes-gujarat-its-home-for-its-sixth-factory-in-the-country/articleshow/68578381.cms?from=mdr↩︎

https://www.autocarpro.in/news-national/doosan-bobcat-sets-up-its-first-india-plant-in-chennai-43951↩︎

https://blogs.imf.org/2020/04/14/the-great-lockdown-worst-economic-downturn-since-the-great-depression/↩︎

https://economictimes.indiatimes.com/markets/stocks/news/nbfc-crisis-poses-more-bad-loan-risks-for-banks-moodys/articleshow/72520496.cms?from=mdr↩︎