what-may-change-for-oems-of-construction-equipment-in-india-post-covid

This article discusses micro perspective and focusses on OEMs as individual entity and not on industry as a whole. Challenges for the industry has been discussed in a different article.

Construction equipment industry may face some challenges post covid, but overall industry in India should be able to overcome slowdown (and even grow) in time and with favourable fiscal policies. How much time depends on when and how are the fiscal policies announced and more importantly, executed. Individual OEMs may face some challenges in short as well as long term.

Short term

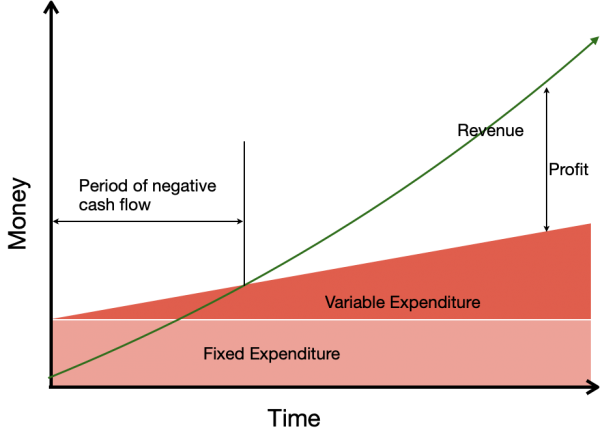

Recovery of market doesn’t happen overnight. At least, that is not usual. Revenue increase from zero to peak will take time and is dependent on external factor(s) to a substantial extent. Expenditures of an organization however, do not behave in similar manner. During this period, expenditure can be expected to be higher than revenues. The biggest challenge hence, is the challenge of financial sustainability.

Sustaining the period of negative cash flow is the challenge in short run

Cost cutting measures are a natural reaction. Some companies may take that route.

There are two things required to survive in the short run. Control expenditure and increase revenue. There are other ways for reducing expenditure including shutting down offices etc. However, identifying that kind of solution is not the aim of this article.

Other options include optimising production process. One of the time tested method of controlling expenditure is just in time manufacturing. Strong forecasting is necessary to reap the benefits. In CE industry in India, owing to low volumes (compared to, for e.g. consumer goods) and unpredictable trend of Govt. expenditure, predictive analytics using external data will not work. Short term forecasting using internal data is possible in a well integrated system. However, despite capability, this is not a practice. And implementing it now to expect result in short run won’t work.

Hence, cost cutting measures are limited in the industry.

If cost cutting is not the way to go in short run, increasing revenue could be. But, as discussed earlier, demand will take some time to pick up. In this scenario, increasing revenue could be a challenge.

Possible solution

There are two possible solutions, which could be implemented simultaneously.

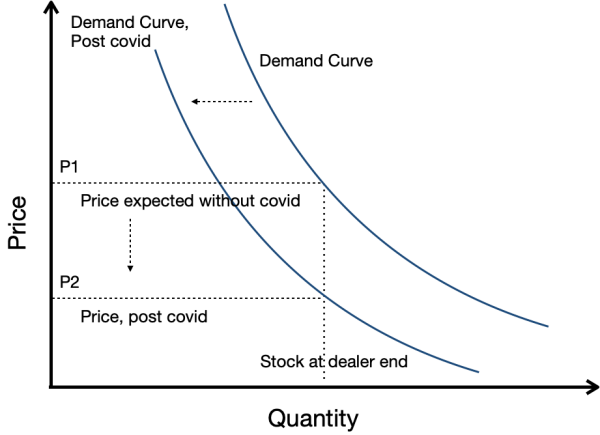

There should be an existing stock of equipments at dealers’ end. The focus of sales should be to clear out this stock by providing different schemes. This means reduced profit, but in short run, cash flow is more important than profit. This is not going to be easy because the demand will not pick up immediately. However, the effort should be to pre-pone sales plan of prospects by allowing incentives.

Reduced price is required to clear dealer stock because of shift of demand curve

Second and more effective is to focus on after sales support. This industry loses immense amount of revenue prospect in after sales to the local market. In fact, according to sources, some of the top selling models are sold because of availability of support in local market. The effort should be to recapture this market. This means providing proactive machine inspection and pushing spare parts at heavy discounts. In fact, a winning tactic could be supporting competitor machines as well. Several models in the industry use same parts. Moreover, proactive service to competition customers builds the path for future sales.

To summarise, alternative revenue streams need to be explored. This means increasing market share in after-sales business through proactive inspection and aggressive promotion of spare parts.

Long Term

Construction Equipment industry is a highly competitive one. The sales volume is limited. In 2018, excavator sales was just more than 25000.1 And there are more that 10 manufacturers fighting tooth and nail to gain market share. Post pandemic, thanks to plans of heavy investment in infrastructure, more players can be expected to enter the market. Although industry volume may increase (eventually), but so will the competition. When the competition increases, profits may come down in equipment sales.

Hyundai entered Indian market about a decade back, aggressively promoted it’s product and built a thriving business.2 For sure, this did not happen without some existing players losing market share (and possibly profit).

<script type='text/javascript'> var divElement = document.getElementById('viz1591102405476'); var vizElement = divElement.getElementsByTagName('object')[0]; vizElement.style.width='100%';vizElement.style.height=(divElement.offsetWidth*0.75)+'px'; var scriptElement = document.createElement('script'); scriptElement.src = 'https://public.tableau.com/javascripts/api/viz_v1.js'; vizElement.parentNode.insertBefore(scriptElement, vizElement); India and China are the only major economies with positive growth expectation, attracting competion

Construction equipment sales is not effected by interest rates, but the sales depend on availability of credit. Credit in this industry comes mostly from NBFCs who were not having a great time in recent times.3 NBFCs will naturally seek to finance assets with low risk. This means they may tend to finance models whose resale value is higher. Other models, in that case, will naturally suffer. This is a bad news for some and mixed for others. One OEM that sells the highest number of backhoe loaders may be comfortable selling backhoe but may miss out on Excavator and vice versa.

This scenario of price war and credit crunch is an exciting time for machinery enthusiasts like me. Because this calls for innovation.

Possible Solution

The solution is not straightforward and one size doesn’t fit all. Nonetheless, the need of the hour to increase efficiency in every aspect of business and innovate solutions.

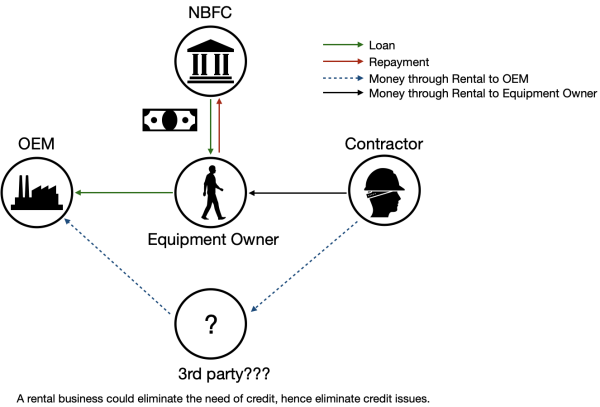

Credit issue

Credit is an issue for a segment of customers. Mostly first time buyers in the rental segment are effected. These buyers purchase the equipment and rent it out to contractors. One way is to negotiate with NBFCs and provide incentive to finance assets. The industry practices this by providing subvention. However, the fact remains that subvention is not an insurance against NPA. If the loan goes bad, what matters is the resale value of the equipment. Subvention does not help with that. Hence, it is only justified to say the subvention is not a long term solution to solve credit issues.

One option is of course, to focus on credit worthy customers. That remains a priority but cannot remain an exclusive focus because of limited volumes and high competition.

Used equipment

One way could be establishing a used equipment business. Companies across the globe are venturing into that. There are giants like Ritchie Bros. playing in this ground internationally since decades. Indian OEMs have also started exploring the possibility.4 With an established used equipment business, OEMs can offer guarantee to NBFCs to purchase the asset in case of default by the customer.

An important strategy could be to tap into the international trade of used machinery. Developing nations who do not have a substantial manufacturing base depend on imported used equipments, including some of our neighbouring nations. According to Trademap, in 2019, international trade volume of earthmoving machinery exceeded USD 11 B.5 Assuming that 20% of this was used, more than USD 2 B worth of used earthmoving machinery was traded internationally. This is in addition to the domestic trade.

Rental

Second option could be rental business. OEMs can start renting out to the contractors. With the wide network of dealers across the nation, this could be a lucrative business. There are several startups coming up in the some parts of the globe with this model. But OEMs are yet to show any interest in this. Of course, it is not their core competency. In such case, tying up with suitable partners could be an option. Point is, rental business can help eliminate the credit issue altogether by eliminating need of credit.

These concepts of rental or used equipment business is not a radical transformation. These businesses already exist. The trick is to capture a share out of this existing and well established business.

Competition

Price wars (and competition) are won by creating additional value for customers. Also, it calls for higher efficiency in everything we do. When it comes to creating additional value, equipment industry is sitting on immense amount of opportunity. With advent of telematics in the industry, immense amount of data is available on performance and usage of equipment.

Digital initiatives

Efficiency can be increased by digital initiatives and using data to drive business decisions. For e.g. using data to forecast, rather than asking sales person,“How much will you sell?”. Or instead of seeking feedback on service using a call centre, use whatsapp bot or even text message based tools. One of the best way to do this is to ask employees about the tasks that they repeat substantially and try to automate them using technology. A futuristic bot may look similar to what is shown below.

Telematics

Telematics can help OEMs innumerable ways, some of which are as follows.

- Plan proactive service and inspection and increase after-sales business

- Predict failures beforehand and take proactive action. This will reduce breakdown and increase customer satisfaction

- Earn money helping battery and tire companies by informing them about possible need

- Gradually build industry standard of maintaining service records to gain additional resale value and reduce prospect of losing after-sales business to local market

- Sell fleet management services to fleet owners

- Improve existing product features and customisations

- And many more

When struggling for ideas, one can always look towards what other industries are doing and seek inspiration.

New Markets

Finally, there is an option to create new markets. It is not necessary that an excavator will only be used in road work or mines. There could possibly be a use in orchards for example. A business development initiative could come in handy at times like this. Furthermore, export markets can be a very lucrative option. This include used equipment market(s) of neighbouring countries as well.

International market can be an option of ‘new market’ for OEMs in India

Summary

The possibilities are immense and will vary depending on OEM, their product and situation.

A word of warning is essential at this point. Sources have confirmed that several digital initiatives have not been successful in the industry. Hence, it is worth saying that it is wise to implement the solutions in agile manner. Rather than planning one big step, it is advisable to take small ones, analyse result and improve to add another step.

| Issue | Possible solutions |

|---|---|

| Lack of credit availability | 1. Establish used equipment business and provide buy back guarantee |

| 2. Create a vertical or tie up with suitable partners for rental business to eliminate need to financing | |

| Competition | 1. Implement organisation wide digital initiatives and use data driven decisions to improve efficiency |

| 2. Use the magic of telematics to innovate solutions, create additional value for customers and improve product |

In summary, to sustain profitability in the long run, innovation is necessarily, especially to overcome competition and credit issues. Moreover, increased focus on after-sales business is necessary. Several options exist and not all of them may be suitable for every OEM. Detailed (and customised) analysis is required find the suitable one(s) for each OEM.

For obvious reason(s), details of the possible solution has not been discussed. In case you are interested to discuss and explore how exactly this can work in a particular scenario (even for your organisation), feel free to contact me. I am up for a discussion over a cup of coffee.